Unlocking MicroStrategy's Bitcoin Premium: A Data-Driven Analysis

The Challenge: Understanding MSTR’s Valuation Premium

MicroStrategy (MSTR) presents a fascinating case study for financial analysis. While the company began as a business intelligence software provider, it has transformed into what it calls “the world’s first and largest Bitcoin Treasury Company.” As of May 2025, MicroStrategy holds over 555,000 Bitcoin on its balance sheet, yet its stock price reflects a significant premium beyond the value of these holdings.

This premium raises a key question: How much of this premium is attributable to MicroStrategy’s software business versus other factors like its Bitcoin acquisition strategy?

To answer this question, I embarked on a data-driven journey with Claude that illustrates how AI can enhance financial analysis when provided with the right data. Here’s how I approached this challenge.

Step 1: Document Processing and Summarization

The first obstacle was one of data scale. MicroStrategy’s financial filings are extensive documents that exceed Claude’s context window. To address this, I:

- Collected MicroStrategy’s most recent financial filings (10-K and 10-Q)

- Used Claude in previous sessions to create condensed summaries of these documents

- Generated structured financial summaries focused on key metrics for both the Bitcoin holdings and software business

This approach transformed hundreds of pages of SEC filings into concise financial summaries that captured the essential information needed for analysis, including:

- Bitcoin holdings and acquisition strategy

- Software business revenue breakdown

- Operational metrics for the software segment

- Debt structure and capital allocation

- Business model transition indicators

Step 2: Premium Analysis with Claude

With these summaries prepared, I engaged Claude to analyze the relationship between MicroStrategy’s Bitcoin holdings and its market premium. The analysis focused on:

- Calculating the precise Bitcoin holdings value based on current prices

- Quantifying the market premium beyond Bitcoin holdings

- Evaluating the software business using standard industry valuation metrics

- Assessing the software business transformation from licenses to subscriptions

- Comparing the market premium with estimates of the software business value

Claude processed these inputs and created interactive visualizations to help understand the components of MicroStrategy’s valuation.

The Findings: A Significant Premium Beyond Software Value

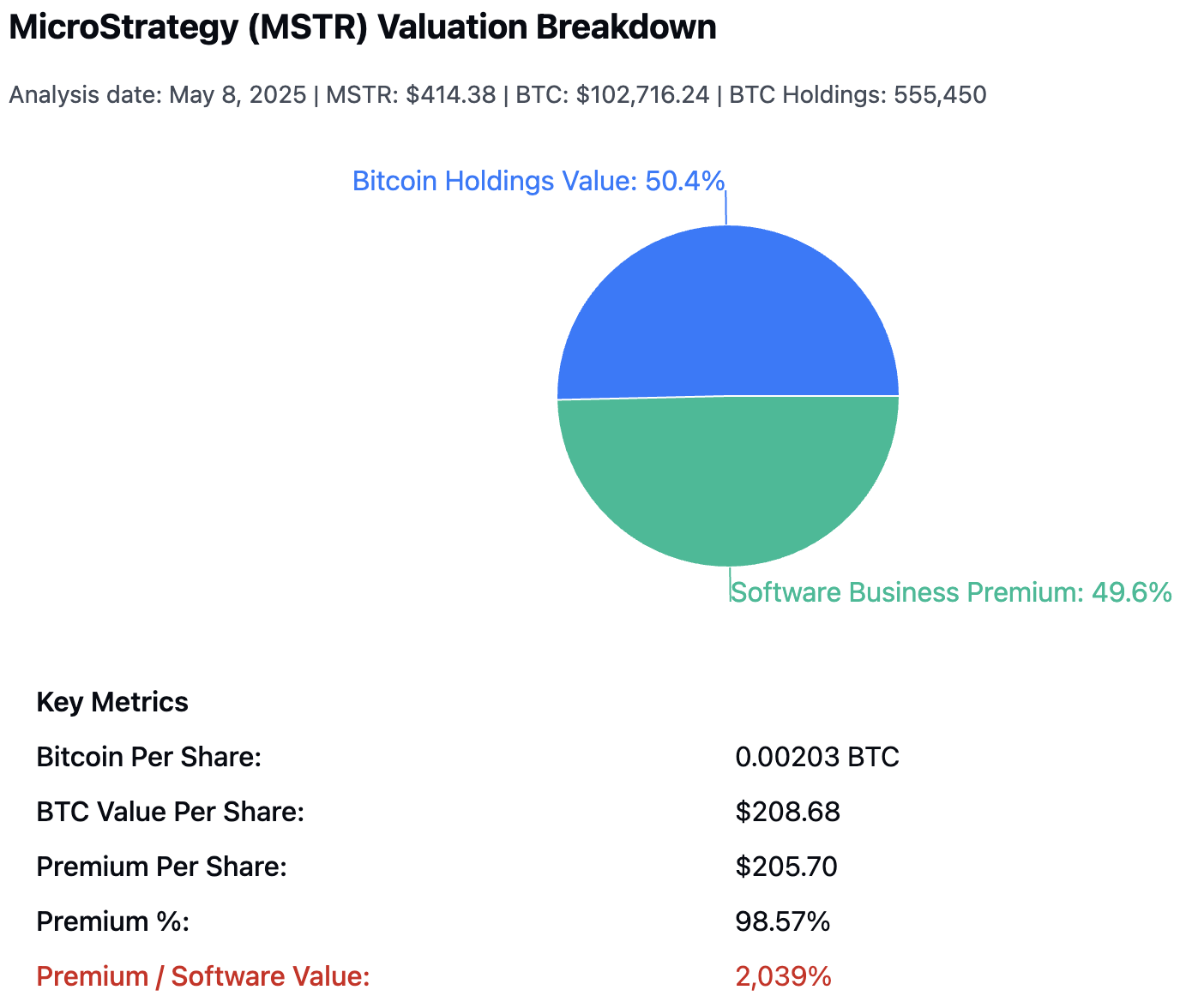

The analysis revealed some striking insights about MicroStrategy’s valuation as of May 8, 2025:

|

|

|---|---|

| MSTR Valuation Breakdown | MSTR Valuation Components |

Key Metrics:

- Bitcoin Holdings Value: $57.05 billion ($208.68 per share)

- Market Premium: $56.24 billion ($205.70 per share)

- Premium Percentage: 98.57% of Bitcoin value

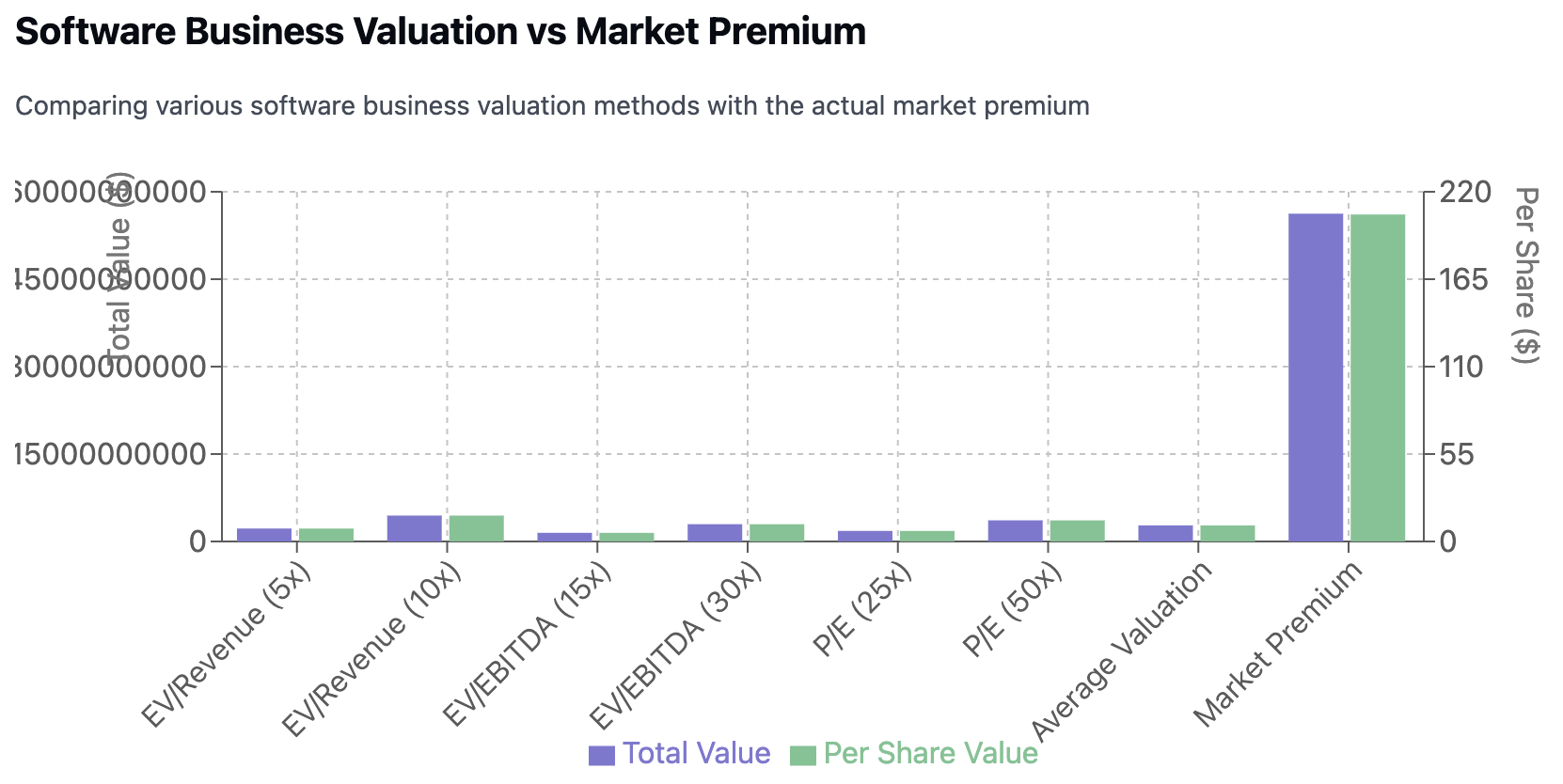

What’s particularly interesting is how this premium compares to traditional software business valuation metrics:

Using standard industry multiples for comparable SaaS companies:

- EV/Revenue (5x-10x): $2.22B-$4.44B

- EV/EBITDA (15x-30x): $1.48B-$2.96B

- P/E (25x-50x): $1.81B-$3.63B

- Average valuation range: $1.84B-$3.68B ($6.72-$13.45 per share)

The surprising conclusion: The market premium is approximately 20 times higher than what traditional valuation methods would suggest for MicroStrategy’s software business.

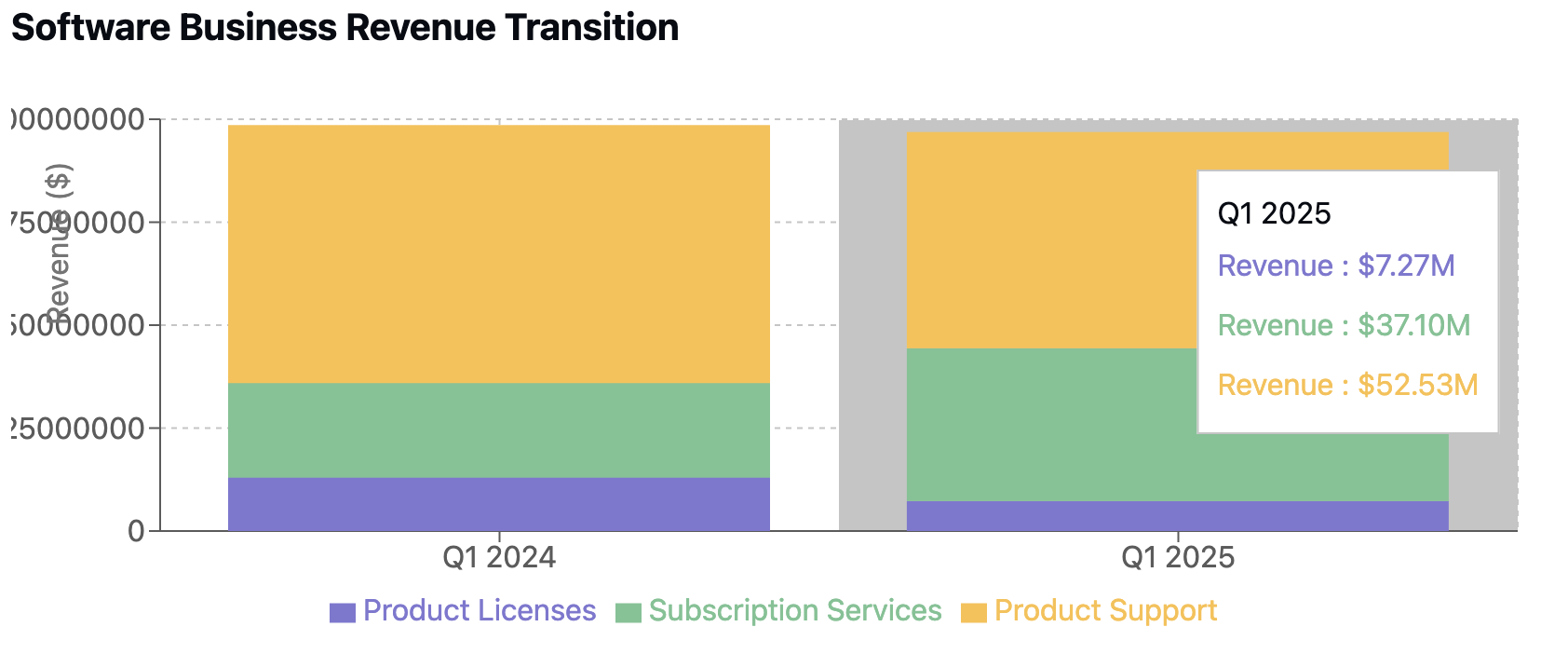

Software Business Transformation

The analysis also provided insights into MicroStrategy’s software business transformation:

The company is successfully transitioning from a perpetual license model to cloud subscriptions:

- License revenue declined 43.8% YoY

- Subscription services grew 61.6% YoY

- Recurring revenue now accounts for 80.7% of total revenue

This transition aligns with broader industry trends toward cloud-based subscription models, and MicroStrategy appears to be executing this strategy effectively.

Bitcoin Acquisition Strategy

Another important aspect of MicroStrategy’s story is its Bitcoin acquisition strategy:

The company has shown remarkable execution in its “21/21 Plan” to raise $21 billion each in equity and fixed income:

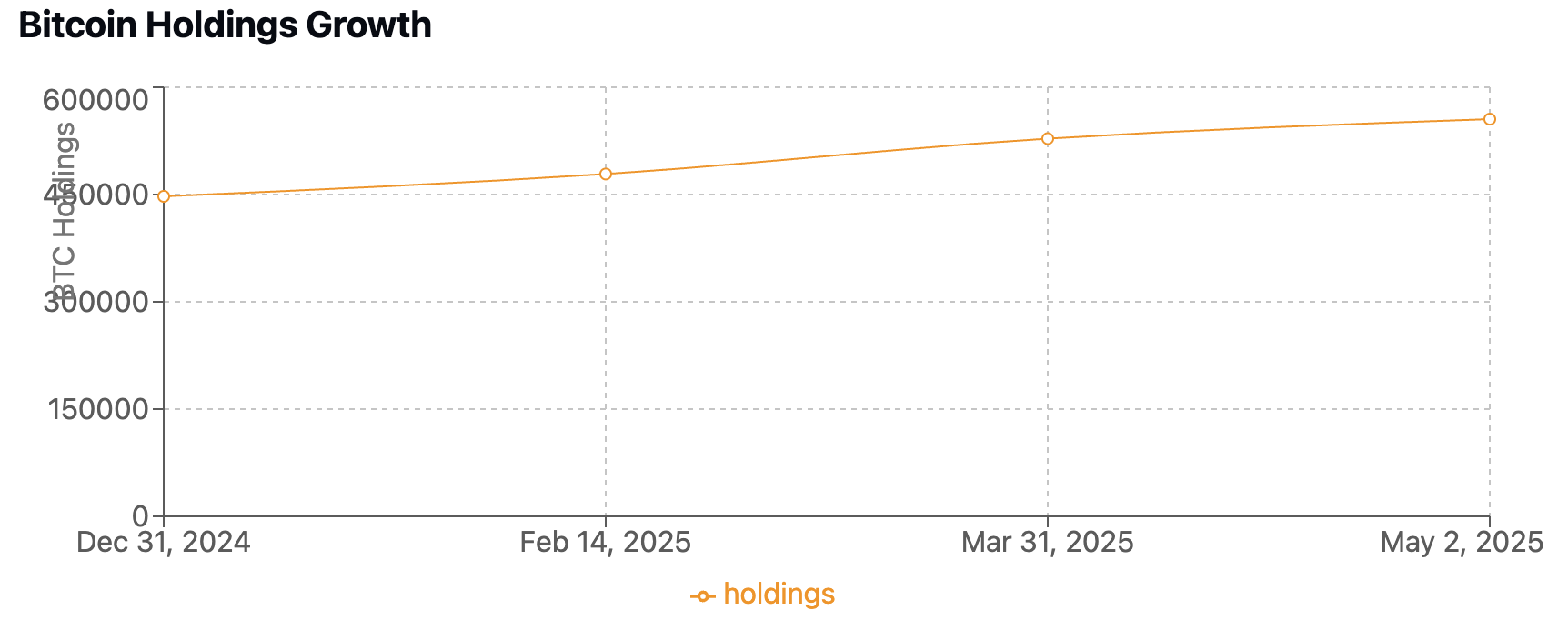

- Bitcoin holdings grew from 447,470 (Dec 2024) to 555,450 (May 2025)

- Average cost basis of $68,550 per Bitcoin vs. current price of $102,716

- Current unrealized gain of approximately $19 billion

Explaining the Premium

So if the software business is worth approximately $2.8 billion (average estimate), why does MicroStrategy command a $56 billion premium over its Bitcoin holdings?

The answer likely lies in a combination of factors:

-

Bitcoin Acquisition Capability: The market values MicroStrategy’s demonstrated ability to raise capital and acquire Bitcoin efficiently.

-

Operational Leverage: Unlike Bitcoin ETFs, MicroStrategy generates cash flow from its software business to support its Bitcoin strategy.

-

First-Mover Advantage: As the first major public company to adopt a Bitcoin treasury strategy, MicroStrategy has established itself as a pioneer.

-

Institutional Access Vehicle: MicroStrategy offers institutions a regulated, familiar way to gain Bitcoin exposure through traditional equity markets.

-

Future Expectations: The premium may reflect expectations about future Bitcoin price appreciation and additional acquisitions.

Conclusion: More Than the Sum of Its Parts

This analysis demonstrates that MicroStrategy is valued at far more than the simple sum of its Bitcoin holdings and software business. The market appears to be placing significant value on the company’s Bitcoin treasury strategy itself.

For investors, this raises important questions about the sustainability of this premium and whether it accurately reflects MicroStrategy’s long-term value proposition. The premium could be justified if the company continues to successfully execute its Bitcoin acquisition strategy and completes its software business transformation.

This case study also highlights the power of AI-assisted financial analysis. By leveraging Claude to process and analyze complex financial data, I was able to gain insights that might otherwise require a team of analysts.

What are your thoughts on MicroStrategy’s valuation premium? Does the market’s assessment make sense, or is the premium excessive? I’d love to hear your perspective in the comments.

This analysis was conducted using data from MicroStrategy’s public financial filings as of May 2025. The interactive visualizations were created using Claude 3.7 Sonnet. This post is for informational purposes only and should not be considered investment advice.